Credit card processing statements are infamous for unintelligible acronyms, hidden fees and a host of other line items designed to befuddle even the most thorough examiners. Confido Legal's statements are designed to be understandable.

Location

- To find your Confido Legal summary statement, navigate to Reports > Statements. You will see a statement for each month in which your firm processed a transaction.

- If there are no transactions processed during the month, no statement will be generated.

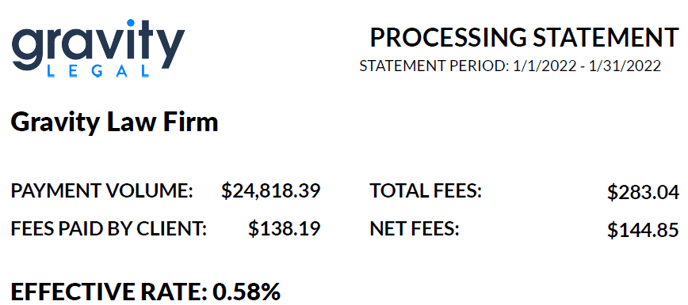

The Summary Section

This section shows a summary of your firm's activity for the month.

- Payment Volume: This is the total amount your firm processed across all of your accounts (trust and operating) and via all of your payment methods (credit/debit and ACH).

- Total Fees: This is the total fee amount charged to your firm during the statement period. If you are using our surcharging program, then this includes all fees paid by clients.

- Fees Paid by Clients: If you are using our surcharging program, this is the total amount of fees paid by the clients.

- Net Fees: This is the total fee amount less any fees paid by clients. This is your firm's net expense for the month.

- Effective Rate: This is Net Fees divided by Payment Volume. This is an important number to review as it shows the actual cost to your firm of processing online payments.

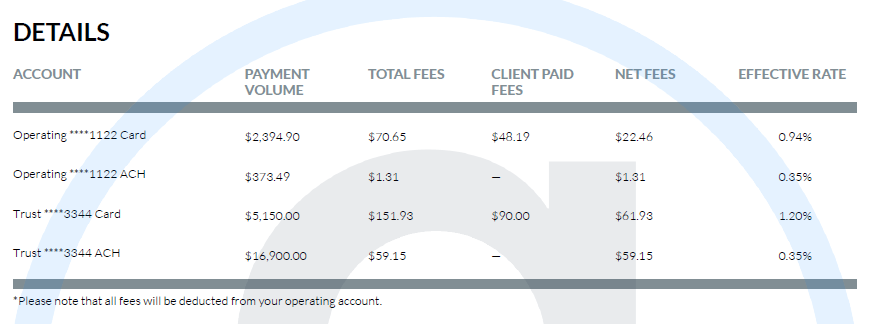

The Details Section

This section breaks down the volume and fees by bank account (trust and operating) and payment method (card and ACH). The definitions of the columns are the same as those listed above.

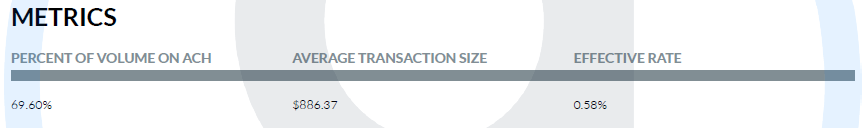

The Metrics Section

This section shows key metrics that will help you track actions impacting your cost of processing.

-

Percent of Volume on ACH: This is the ACH payment volume divided by the total payment volume. A higher percentage will typically reduce your processing costs because ACH is the least expensive way to move money.

-

Average Transaction Size: This is the total payment volume divided by the number of transactions.

-

Effective Rate: This is the same number that is also listed in the summary section. It is calculated by dividing Net Fees by Payment Volume.

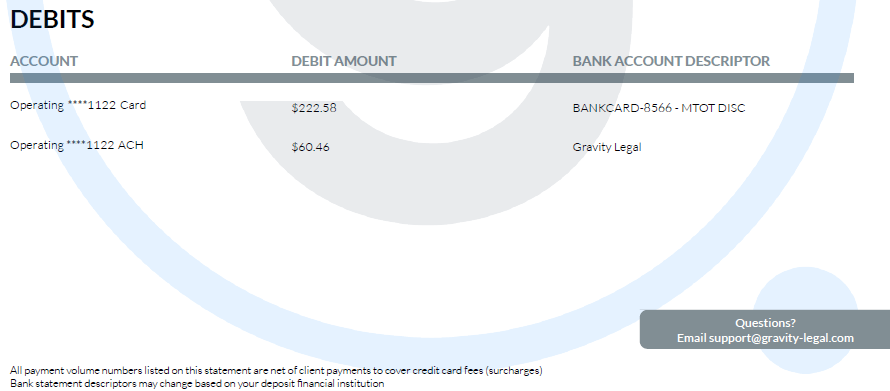

Debits Section

This section shows what you can expect to be debited from your operating account.

- All fees will be debited from your operating account.

- Card processing fees and ACH fees get billed separately.

- Card processing fees are usually debited on the 1st or 2nd of the month. E.g., January fees would be debited on February 1st.

- ACH fees are usually debited on the 10th of the month. E.g., January fees would be debited on February 10th.

- The fees shown on the Confido Legal statement should match your bank statement and they should add up to the Total Fees shown in the summary section.

-1.png?height=120&name=Confido%20-%20Trademark%20-%20Dark%20(2)-1.png)