This is a guest post by law firm financial expert Brandy Derrick of Legal Ease Bookkeeping.

Every career has its own set of lingo, special terms, and years of learning to master. Attorneys work very hard to become skilled in their field, mastering enormous amounts of knowledge, terminology, and concepts. Although busy with his or her practice, an attorney would do well to learn the basic terms of the financial statements. Understanding each one will help an attorney profit and make adjustments in business.

Read More

Topics:

Firm Financials,

Key Performance Metrics,

Business of Law

Here's our nearly 20 page white paper on law firms shifting processing credit card processing fees to clients.

Read More

Topics:

Firm Financials,

Credit Card Fees,

Business of Law

“I was told there’d be no math.” It’s a common joking refrain for law students and even practicing lawyers. “I went to law school to help people,” so many lawyers tell me. But a firm needs to pay for you - and itself - in order to keep helping people. Let’s face it: law firms are businesses. And the better a firm runs, the more people it can help. So understanding the finance and economics of a legal services business is crucial. That’s where Kenna comes in.

Read More

Topics:

Firm Financials,

Financially Legal Episodes

For many law firms, credit card processing fees are a sizeable item on the income statement. Because there are a variety of different types of processing fees, it can be difficult to determine exactly how much a firm is paying and how those fees can be reduced.

This event is designed for accounting and financial consulting professionals who work with and advise law firms. We will cover:

Read More

Topics:

Firm Financials,

Credit Card Fees,

Business of Law,

Confido Legal News

Recently, our team invited seasoned litigator Diana Siri Breaux, a partner at Summit Law Group in Seattle, to interview Confido’s founder and CEO Dan Price about this very topic. As a longtime business owner, Dan has his fair share of experience with the legal system. In 2016, that experience reached new levels when Dan’s brother and co-founder, Lucas Price, took him to court after alleging that Dan’s decisions as CEO--including the decision to raise Confido’s minimum wage to $70,000 a year--had cost him money as a minority shareholder. At stake was not just millions of dollars but the very existence of the company--and the jobs of its 120+ employees.

Read More

Topics:

Firm Financials,

Business and Culture,

Business of Law,

Confido Legal News

This September I had the pleasure of speaking to the innovative lawyers, mediators and greater dispute resolution community members at the American Bar Association's Dispute Resolution Tech Expo.

Read More

Topics:

Firm Financials,

Key Performance Metrics,

IOLTA,

Business of Law,

Confido Legal News

Listeners and readers have been pretty interested in our recent podcast on how lawyers talk to clients about money and our recent blog post about how one client (and Confido Legal team member) wishes lawyers talked to them about money. So, we decided to ask the experts how lawyers should talk to clients about money.

Read More

Topics:

Firm Financials,

Business of Law

This is a guest post by divorce attorney and firm owner, Russell Knight, of Chicago, Illinois.

Almost all lawyers have a retainer or a large initial payment for legal services. Lawyers and clients enter into engagement agreements which specify how that retainer or payment is to be accounted for. Specifically, the money will be applied towards the lawyer’s hourly billing or specifically itemized tasks.

Read More

Topics:

Firm Financials,

Business of Law

I’ve put it off all week, but the time has come. I need to pay our law firm. They do great work and have helped protect our company during difficult times. But paying their bill is not a pleasurable experience.

Read More

Topics:

Firm Financials,

Business and Culture,

Business of Law

Conventional wisdom is that there are really only two reasons that marriages end: sex and money. Sex with a client is frowned on and talking about it - except, perhaps as a part of the representation - is probably not a great idea. However, conversations with clients about money can be some of the most important conversations you have with them.

Read More

Topics:

Firm Financials,

Financially Legal Episodes

Collection rate is defined as the revenue you actually collect into your operating bank account divided by the total amount invoiced. Typical collection rates for law firms are around 85%, but they vary markedly by firm. Increasing your collection rate is a great way to earn more without actually doing any additional work.

Read More

Topics:

Firm Financials,

Key Performance Metrics,

IOLTA,

Business of Law

Dan Lear was recently interviewed by Mark Homer of legal marketing firm GNGF. Dan and Mark dove into many different topics including:

- Company culture

- A $70,000 minimum wage

- The Confido Legal platform

- Law firm finance

- Alternative fee structures

- Expectations of the modern consumer of legal services

Read More

Topics:

Firm Financials,

Key Performance Metrics,

IOLTA,

Accounting,

Business and Culture,

Business of Law,

Confido Legal News

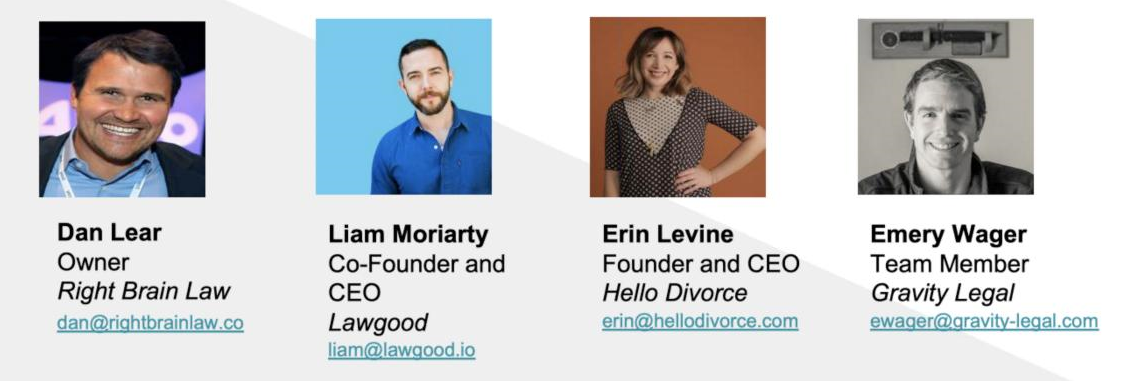

This week Dan Lear and Emery Wager joined Erin Levine of Hello Divorce and Liam Moriarty of Lawgood to talk the future Legal Tech.

Read More

Topics:

Firm Financials,

Key Performance Metrics,

Business and Culture

Written By Devon Thurtle Anderson, CEO of Financial Consulting Firm, Skepsis

When I first left my law practice to become a law firm bookkeeper and financial strategist, I was shocked to discover how many law firms struggle with cashflow. Even more surprising was that this struggle isn’t just limited to a few seemingly rag-tag solo general practice firms. To the contrary, when I had a chance to look under the hood at dozens of law firms’ books and financial records – including law firms I had always seen as hugely successful – I learned that almost every law firm has a cashflow problem within any given 12-month period. So, as part of my bookkeeping and consulting services, I set out to change that.

Read More

Topics:

Firm Financials,

Credit Card Fees,

Key Performance Metrics,

IOLTA,

Accounting,

Invoices,

Business of Law

Credit cards are a great way to get paid more quickly. The Clio trends report shows that firms who accept credit cards get paid 39% faster than those that don't.

But credit cards are expensive. For invoice or trust payments where the client enters the card, rather than swiping or dipping, the cost generally hovers around 3%. Furthermore, credit cards are not the only way to provide a high-quality online payment experience.

Shopping around for better rates can save you a few tenths of a percent, but here are two changes you can make to drastically reduce card fees while still getting the benefit of speedy payments.

Read More

Topics:

Firm Financials,

Credit Card Fees,

Business of Law

Managing accounts receivable is important when times are good. But when times are tough, how effectively firms turn accounts receivable into cash can be the difference between going under and thriving.

Expert law firm financial consultant, Chelsea Williams of Core Solutions Group has an excellent video outlining four tips for effective accounts receivable management. Below is a summary, but we highly recommend checking out the video.

Read More

Topics:

Firm Financials,

Key Performance Metrics,

Business of Law

Starting back on March 23, RJon Robins of How To Manage a Small Law Firm held a series of free daily phone conversations with lawyers in response to the coronavirus/COVID-19 pandemic. RJon was his typically direct but his message was hopeful: there is opportunity out there for lawyers and law firms .

Read More

Topics:

Firm Financials,

Business of Law,

Confido Legal News

In this episode of Clio Matters, Dan discusses different ways firms are navigating the new remote work environment. He lists helpful technology resources and tells us whose ideas he's leaning on amidst the chaos (Nate Silver and RJon Robins of How to Manage a Small Law Firm to name a few).

Read More

Topics:

Firm Financials,

Credit Card Fees,

Key Performance Metrics,

IOLTA,

Confido Legal News

We get nerdy this episode talking accounting, trust accounting, and regulatory jazz with Lainie Hammond. Lainie runs a law firm in Washington State helping lawyers with issues related to IOLTA trust account compliance.

Read More

Topics:

Firm Financials,

Financially Legal Episodes,

IOLTA

Our lives and livelihoods have changed dramatically over the last two weeks. We’re all hopeful for a swift and significant rebound, but proactive measures will carry the day. Action in crisis can provide a feeling of purpose and normalcy amidst the potentially overwhelming uncertainty. It can also be the difference between going under and thriving.

Read More

Topics:

Firm Financials,

Credit Card Fees,

Business of Law

There are three sets of rules lawyers need to navigate when deciding whether to charge clients a fee for paying with a credit card:

Read More

Topics:

Firm Financials,

Credit Card Fees,

Business of Law

Whether your firm is in need of financial assistance or you are working to advise clients through these difficult times, we've compiled a list of local, state and national Covid 19 financial relief programs.

Read More

Topics:

Firm Financials,

Business of Law

Today, we're excited to have a conversation with John E. Grant, the Agile Attorney. John is a compelling thinker when it comes to law firm economics, law firm efficiency, and law firm productivity.

Read More

Topics:

Firm Financials,

Financially Legal Episodes,

Key Performance Metrics

Welcome to the very first episode of Financially Legal, with your host, Dan Lear, head of partnerships and marketing at Confido Legal.

Read More

Topics:

Firm Financials,

Financially Legal Episodes

Oklahoma Attorney General, Mike Hunter, in a recent opinion said a state ban on surcharging is most-likely unconstitutional. Surcharging is the practice of charging an additional fee when clients pay by credit card.

Clients should know what it costs law firms to accept credit cards, and those clients should have the option to save money by paying with less expensive methods. Since card brand surcharging rules prevent firms from charging more for the surcharge than the amount of the transaction, it ends up not being a money-making scheme but a clear way to communicate how much those airline miles really cost.

Read More

Topics:

Firm Financials,

Credit Card Fees,

Business of Law

Getting clients to pay isn’t easy. As more invoices remain outstanding, accounts receivable creeps upward. As an attorney responsible for the firm's financial success, it's important to understand the real cost of accounts receivable. Here's a simple way to estimate those costs.

Read More

Topics:

Firm Financials,

Business of Law

For many law firms, credit card processing fees are a sizeable item on the income statement. Because there are a wide variety of different types of processing fees, it can be difficult to figure out exactly how much you’re paying. It's also why, at Confido, we try to simplify this process as much as possible, primarily by offering a fair and transparent pricing structure while providing all the important information in a one-page monthly statement without the jargon. In this article we'll cover the three different categories of processing fees as well as the most commonly-used credit card processing pricing models.

Read More

Topics:

Firm Financials,

Credit Card Fees,

Surcharging,

Business of Law

Introduction

The short answer is probably, but there are certain rules and regulations to understand.

Read More

Topics:

Firm Financials,

Accounting,

Surcharging,

Business of Law

Introduction

The short answer is probably not. See below for all the details.

Read More

Topics:

Firm Financials,

Accounting,

Surcharging,

Business of Law